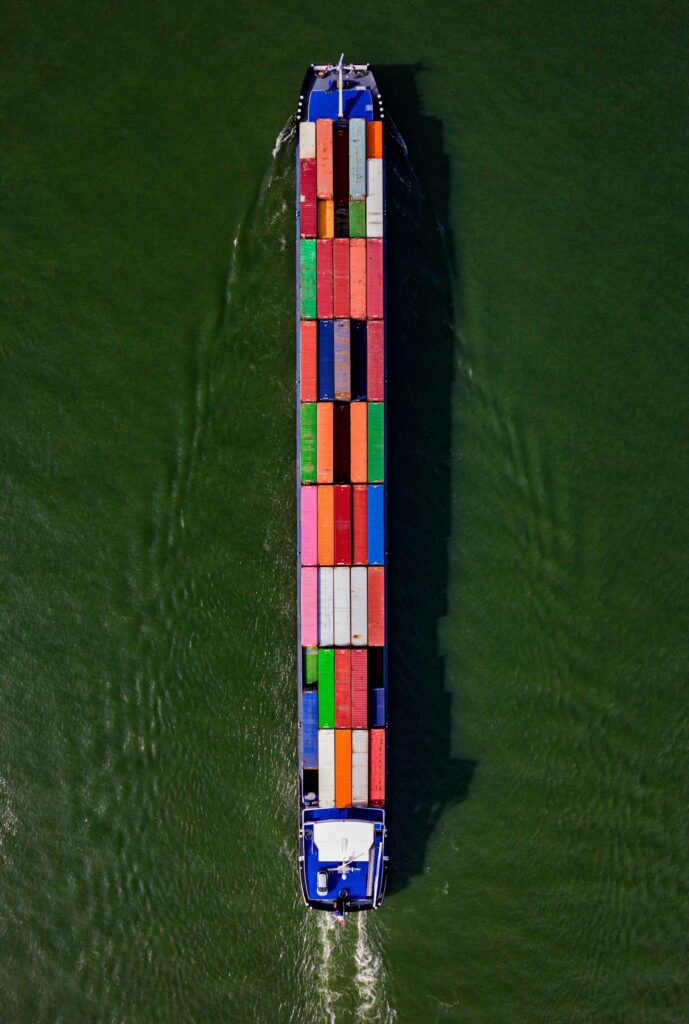

Transportation, Trucking, Logistics

and Related Services

Region: Australia and New Zealand

Enterprise Value: A$10m - A$80m

Opportunity Overview

Blue Harbour Capital is working with strategic investors and experienced transportation and logistics executives who are seeking to partner with a trucking, logistics or related transport services business on an employee led or management led buyout.

This mandate is ideal for a founder who wants to exit or step back, while enabling the existing management team and key employees to become the majority owners, under Blue Harbour’s employee led succession model and post transaction coaching framework.

Opportunity Snapshot

Sectors of interest

- Road freight and general trucking

- Linehaul and regional freight operators

- Contract logistics and 3PL providers

- Warehousing, distribution and fulfillment

- Refrigerated and temperature controlled transport

- Bulk haulage, tanker, tanker cleaning or specialist transport

- Niche or value added logistics services (for example dangerous goods, last mile, time sensitive freight, oversized loads)

Geography- Australia or New Zealand

- Single state, national or trans Tasman operations

Scale and performance- Enterprise value between $10m and $80m

- At least 3 years of stable or growing revenues

- Consistent profitability with clear visibility on cash flows

- Solid customer base, ideally with contracted or recurring revenue

- Strong compliance and safety record

Ownership and management- Founder or privately held business

- Well regarded management team already running day to day operations

- Owner interested in selling to the management team and key employees, rather than a traditional trade buyer or private equity fund

We are seeking a business that broadly fits the following profile.

Business fundamentals

- Clear positioning in one or more of:

- General freight

- Contract logistics or dedicated fleet

- Warehousing and distribution

- Specialist or high value transport

- Revenue mix that includes:

- Medium to long term customer contracts

- Recurring lanes or dedicated fleet arrangements

- Sensible spread between contract and spot work

- Diversified customer base with limited reliance on any single customer

- Strong operational discipline and safety culture

- Established brand and reputation for reliability, on time performance and service

- Systems and processes that support:

- Fleet planning and optimisation

- Maintenance and compliance

- Costing and margin visibility

Team and leadership

- Credible management team already handling:

- Operations and fleet

- Customer relationships and commercial decisions

- People and safety leadership

- Depth of talent below the founder, including depot or site managers, planners and key account leads

- Appetite among key managers to step into ownership and board roles

- Openness to strengthening the team where needed (for example CFO, COO, safety and compliance, or commercial leadership), with support from our investor and executive partners

Performance and growth

- 3 or more years of stable or growing revenue and EBITDA

- Strong understanding of route and customer profitability

- A pipeline of growth opportunities such as:

- Expanding existing contracts or lanes

- Winning additional work from existing customers

- Entering adjacent regions or service lines

- Adding warehousing or value added logistics services

- Strategic bolt on acquisitions to increase density and scale

Ideal Founder Profile

This mandate is particularly suited to a founder or owner who:

- Wants a planned, de risked succession rather than a rushed or distressed sale

- Cares about their drivers, staff, customers and safety culture, and wants the business to remain independent and well run

- Sees the management team as the natural next generation of owners, but knows they do not have the personal capital to fund a buyout alone

- Is open to:

- Selling a controlling or full stake into a management and employee led structure

- A phased reduction in day to day involvement, such as an advisory or chair role for a defined period if desired

- Wants confidence that the business will continue to operate safely, reliably and profitably after their exit

Under this mandate:

Strategic investors and industry executives with deep trucking and logistics experience will:

- Co invest alongside the team in a supporting role

- Sit on the board or advisory board

- Provide input on:

- Network design, route density and asset utilisation

- Pricing, contract structures and margin management

- Fleet strategy, maintenance and capex planning

- Technology and telematics to improve visibility and performance

Blue Harbour Capital will:

- Structure and coordinate the buyout so that the management team and employees become majority owners over time

- Arrange and align financing between lenders, investors and vendor terms, so the transaction is funded in a sustainable way without over burdening the business

- Lead a post transaction coaching program and 100 day plan so the new owners have clarity, rhythm and support from day one, including:

- A clear operating cadence

- KPI dashboards focused on safety, service, margin and cash

- Regular leadership and board reviews to keep the transition on track

We can also help identify and fill any critical gaps in the leadership team to ensure the next generation of owners is fully equipped.

Is This Opportunity a Fit for Your Transport or Logistics Business?

You may be a strong fit for this mandate if:

- You own a trucking, logistics or related transport services business in Australia or New Zealand

- Your business falls in the $10m to $80m enterprise value range

- Revenue has been stable or growing over the last 3 years

- You have a solid management team in place that could lead the business without you day to day

- You are open to an employee led or management led buyout where your team becomes the majority owner, with experienced logistics investors in a supporting role

- Your priorities include:

- Fair value and certainty for you as founder

- Continuity for staff, drivers and customers

- A safe, well governed and stable business after transition

- Empowerment and retention of your key people

If you are a member of a management team and believe your transport or logistics business fits this profile, we also invite you to make contact confidentially.

Next Step

If this opportunity sounds relevant to your business, the next step is to complete our short, confidential online form. It should take only a few minutes and gives us enough information to understand whether the mandate is likely to be a good fit for you and your team.

We do not ask you to upload financial statements at this stage. The aim is to keep the process low friction while giving both sides enough context to decide whether a confidential conversation makes sense.

Once we receive your profile, we will contact you to schedule a confidential discussion about how a management or employee led buyout with Blue Harbour Capital and our investor partners could work in your situation.